Welcome to ASPIRE!

We’re thrilled to introduce you to this groundbreaking initiative by the Government of Saint Kitts and Nevis, designed just for you. ASPIRE—Achieving Success through Personal Investment, Resources, and Education—combines engaging financial education with real savings opportunities and investments in local companies. Our mission is to help you build financial confidence, grow your savings, and become an active player in our nation’s economic future. Join us on this exciting journey towards financial empowerment and long-term wealth!

About the ASPIRE Programme

ASPIRE—Achieving Success through Personal Investment, Resources, and Education—was established by the Government of Saint Kitts and Nevis in September 2024.

The ASPIRE Programme is built on three key pillars:

SAVINGS

Every participant receives a dedicated savings account, seeded with an initial deposit, to encourage early financial responsibility and long-term wealth accumulation.

INVESTMENTS

A portion of the savings is invested in shares of local, government-owned entities, fostering a sense of ownership and providing an opportunity for financial growth through dividends and reinvestment.

FINANCIAL EDUCATION

Delivered through schools and other institutions, this comprehensive curriculum covers essential topics like budgeting, saving, investing, and entrepreneurship, equipping youth with the skills to make informed financial decisions throughout their lives.

Financial Education

The Ministry of Education and the Eastern Caribbean Central Bank will collaborate to deliver:

Teacher led classroom activities

Age-appropriate training materials

Hands-on, fun, interactive learning experiences

Eligibility Criteria

CITIZENSHIP

Students must be citizens of St Kitts and Nevis.

AGE

Must be age 5-18 or have been 18 or under on 13 December 2023.

RESIDENCY

Must reside in Saint Kitts or Nevis.

SCHOOL

Must be enrolled in school or registered for home schooling.

BENEFIT

Students will be enrolled in a $500 savings account with St Kitts-Nevis-Anguilla National Bank and $500 investment in publicly traded shares.

DURATION

Students must remain in the programme for a minimum of 5 years or until they turn 18, whichever is later.

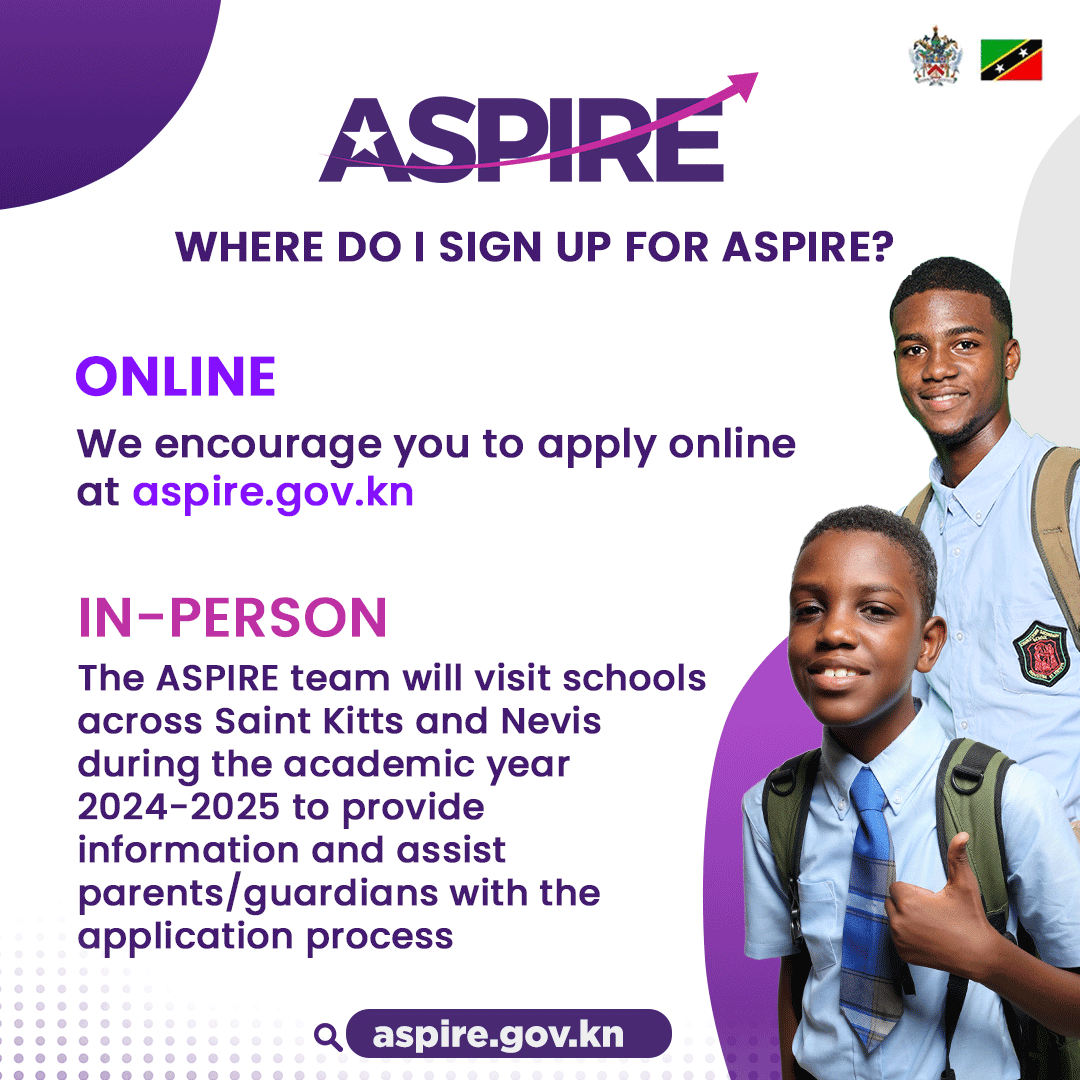

Application Process

The sign-up/apply portal will remain open to facilitate continuous registration of students as they attain their fifth (5th) birthday.

Frequently Asked Questions

General Information

1. What is the ASPIRE Programme?

ASPIRE is a financial education, savings, and investment initiative by the Government of Saint Kitts and Nevis, designed to empower youth through financial literacy, savings, and smart investments.

2. Who is eligible to join the ASPIRE Programme?

All citizens of Saint Kitts and Nevis aged 5 to 18 who are attending school within the Federation are eligible. This includes those citizens registered with the Ministry of Education as home schooled.

3. What evidence of citizenship do I need to provide?

Eligible citizens include Saint Kitts and Nevis born in the Federation or citizens by descent. Applicants must supply one of the following: i) Saint Kitts and Nevis birth certificate or ii) citizenship by descent certificate.

4. When will participants be enrolled?

Following launch in September 2024, ASPIRE participants will be enrolled on a rolling basis following their fifth birthday.

5. At what age can I register for my own account?

ASPIRE participants can register for their own accounts from the age of 12.

Savings Accounts

6. Can I deposit additional funds into the ASPIRE savings account?

Yes, additional deposits can be made into the ASPIRE savings account. Please note that any additional funds, added voluntarily, may not be withdrawn for the duration of the programme.

7. Can I withdraw funds from my ASPIRE savings account?

Funds can only be withdrawn by the ASPIRE participant upon completion of the programme. This includes any additional funds added during the course of the programme. Parents or guardians cannot withdraw funds.

8. Will the savings account earn interest?

Yes, the savings account will accrue interest over time, enhancing the participant’s savings.

9. What happens if an ASPIRE participant passes away or becomes incapacitated before completing the programme?

In such unfortunate circumstances, the funds will be transferred to the participant’s next of kin.

10. How are the funds in the savings account protected?

The funds in the ASPIRE savings account are held securely in the St. Kitts-Nevis-Anguilla National Bank (a government-backed financial institution), ensuring safety and reliability.

Investments

11. What kind of investments are made through the ASPIRE Programme?

A portion of the savings is invested in shares of local, government-owned entities such as the St. Kitts-Nevis-Anguilla National Bank and St. Kitts-Nevis Cable Communications Ltd (“The Cable”).

12. Can the participant choose the investments?

No, the investments are predetermined by the programme and are made in specific government-owned companies.

13. How are dividends from investments handled?

Dividends generated from the investments are automatically reinvested to compound savings and promote long-term financial growth.

14. Can I withdraw my investment before completing the programme?

No, investments are locked in until the participant completes the ASPIRE Programme.

15. How will I know the value of my Aspire savings and investments?

Valuation statements will be issued on a quarterly basis to ASPIRE participants with updates on the performance of their savings and investments.

Financial Education

16. What topics are covered in the financial education curriculum?

The curriculum includes budgeting, saving, investing, entrepreneurship, and financial market literacy, tailored specifically for young learners.

17. How is the financial education delivered?

Financial education is delivered through schools and other institutions, incorporating interactive lessons, workshops, and digital resources.

18. Are there any assessments or exams in the financial education component?

Yes, participants will undergo periodic assessments to ensure they are grasping the key concepts and can apply them effectively.

Programme Completion

19. What happens when an ASPIRE participant completes the programme?

Upon completion, participants gain full access to their savings and investment returns. They will also receive a certificate of completion.

Miscellaneous

20. What if I move abroad?

If an ASPIRE participant relocates outside of Saint Kitts and Nevis, they can continue in the programme, but specific arrangements must be made with the programme administrators.

21. Can parents/guardians monitor the ASPIRE account?

Yes, parents or guardians will have access to view the account activity but cannot make withdrawals.

22. What should I do if I have more questions about the ASPIRE Programme?

For any additional questions or support, please contact the ASPIRE team via email at aspire@gov.kn.

Contact Us

If you have any further questions, contact us at:

EMAIL ADDRESS

aspire@gov.kn

EMAIL ADDRESS

aspire@gov.knPHONE NUMBER

+1 (869) 667-5566

+1 (869) 762-1947